Over 14 million Americans are unbanked or underbanked, according to an FDIC survey reported in a TIME article. This number represents 6% of American households and nearly 17% of Black households.

As we learned on Day 10 from the example of RED, starting to save early on in life, for any purpose, is of great benefit and advantage. It is, however, important to know and understand the different types of accounts you must have and the purpose and benefit of each.

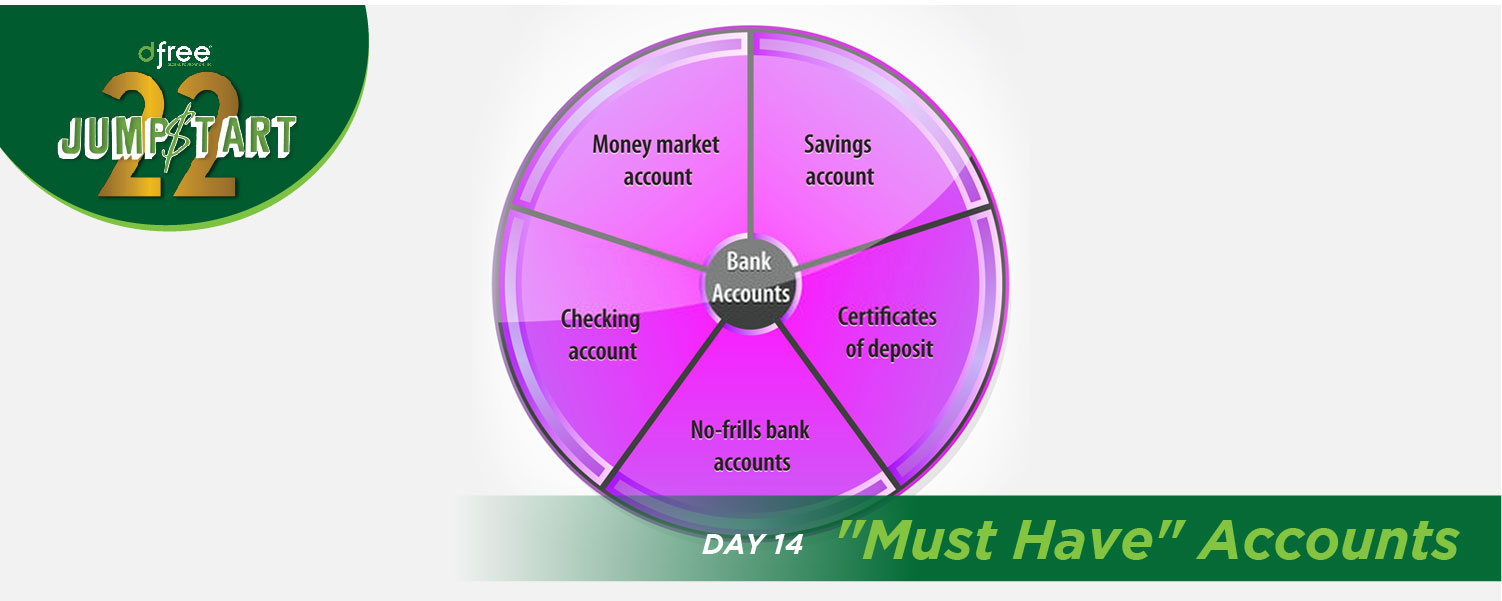

In the dfree® Lifestyle: 12 Steps to Financial Freedom Workbook, there’s a list of some “must-have” accounts, including those mentioned below, to serve as a guide. The context will help you determine which accounts you need. Afterward, you’re encouraged to go and open what you don’t have.

- Bank or credit union checking account

- Bank or credit union savings account

- Investment account

- Retirement account

- College savings account

If you already have a copy of the dfree® Lifestyle: 12 Steps to Financial Freedom Workbook and still need help figuring out your “must-have” accounts, reach out to us; email info@mydfree.org and we’ll help you get started.