There are nine states that don’t tax workers’ wages. But just because a state doesn’t have income taxes doesn’t necessarily mean it’s an affordable place to live.

If a state doesn’t charge income tax, it must find revenues elsewhere, which explains why other tax rates tend to be high in these locations. What’s more, the cost of living in some states with no income tax has soared in recent years, often as a result of skyrocketing home insurance prices related to climate change, as well as higher housing prices in general.

The point is: Moving to a state with no income tax is not a slam-dunk strategy to save money. In fact, if you don’t do the math to factor in other local living expenses, it can seriously backfire. (FYI, the states with no ordinary income tax are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.)

“The correlation between the cost of living and the absence of income tax in a state is relatively weak,” Andrey Yushkov, a senior policy analyst with the Center for State Tax Policy at the nonpartisan nonprofit Tax Foundation, explains to Money via email. “Many other factors affect the cost of living, including property and sales taxes, excise taxes and home insurance. Therefore, the absence of income tax does not necessarily imply that it is cheaper for everyone to live there.”

Rising home insurance and car insurance costs

The state with the highest home insurance rates happens to be one with no income tax. According to the online insurance marketplace Insurify, Florida has the nation’s costliest homeowners insurance, with the average annual policy running $10,996 in 2023. Home insurance in Texas, another destination celebrated for having no state income tax, averages $4,436, good for fourth-most expensive in the country.

These rates are far more expensive than the national average ($2,377 as of 2023), and homeowners in many states are growing accustomed to soaring insurance premiums. Texas saw the nation’s biggest rise in insurance costs in 2023, up 23% year over year, according to S&P Global data.

It’s also simply getting harder to find coverage, period.

Many home insurers are leaving states where climate change is causing costs to soar, including Florida, Louisiana, California and Colorado. This spring, a Texas Monthly writer lamented “What the Bleep Is Going on With Texas Home Insurance?” while rehashing his experiences repeatedly getting denied insurance on a new home, along with tales of other homeowners being hit with premium hikes of 60% or 80%.

It’s a similar story for car owners, who saw average auto insurance prices rise 24% in 2023. And, yes, according to Insurify, many of the states with the highest car insurance prices are places with no income taxes: Nevada has the nation’s second most expensive auto insurance costs (averaging $2,975 for full coverage in 2024), and Florida ($2,917) comes in third.

The takeaway is that insurance cost differences around the country can have a major impact on a household’s budget and lifestyle.

“If someone is considering moving to a state without income tax to save money, they should look into the auto and home insurance market in that area first,” says Cassie Sheets, a data journalist at Insurify. “Some states are seeing bigger increases than others, and several states with no or low income tax are among the most expensive.”

Consider property taxes, sales tax and other expenses

Homeowner property taxes vary dramatically in different parts of the country. There are many counties in rural states where the typical property tax bill is under $300 a year, per Tax Foundation data. Meanwhile, median residential property taxes in several suburban counties in New York, New Jersey and Virginia are over $10,000.

Property taxes are assessed as a portion of a home’s assessed value. So instead of looking just at property taxes in raw dollars, it’s important to consider the rates charged in order to understand their real impact on owners.

New Jersey has the nation’s highest property tax rates (2.23%), followed by Illinois (2.08%). But next on the list comes New Hampshire (1.93%), which stands out in New England for having no general sales tax or taxes on wages. Texas, another no-state-income-tax state, has the sixth-highest property tax rate, at 1.68%.

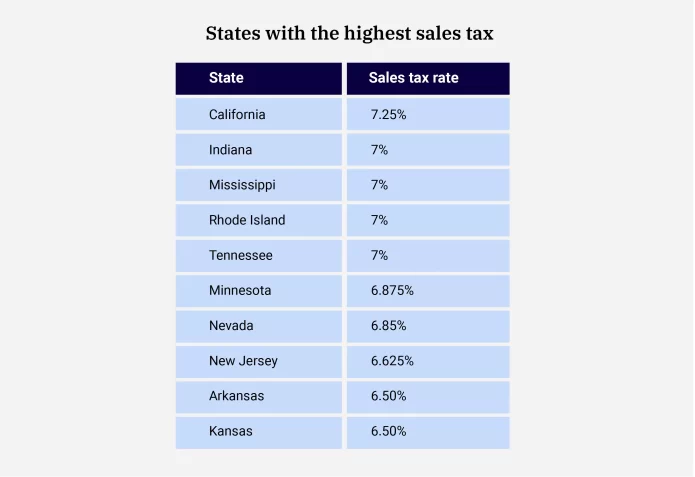

As for sales tax, two states with no income tax are ranked among top 10 for highest rates: Tennessee charges 7%, while Nevada tacks on 6.85%. The sales tax rates in Texas (6.25%) and Washington (6.5%) are high in the grand scheme, as well.

Depending on your consumption habits, sales taxes in these states can add up to hundreds, if not thousands, of dollars in your budget each year.

As the Tax Foundation’s Yushkov tells Money, “for high-income individuals, income taxes may be one of the most important factors” in deciding where to live, assuming they’re aiming to keep as much of their earnings as possible. If you’re not super wealthy or your wealth is not based on income, however, the financial benefits of living in a state with no income tax are less clear.

Before deciding to move to a state with no income tax, you should examine your individual circumstances, including “job opportunities, family considerations, climate, infrastructure, educational system” and various local taxes, Yushkov says.

In addition to taxes on property, purchases and ordinary income, people should find out whether a state charges tax on capital gains, dividends and Social Security benefits, too. It’s worth looking into recurring expenses too, like utility bills: Research indicates that New Hampshire has the highest average utility bills in the mainland U.S. (adding up to about $4,500 a year), while Wyoming has the highest residential energy costs.

Living expenses in states with no income tax

Using data from Insurify, the Tax Foundation, Zillow and other sources, here are some location-specific factors to consider before moving to a state with no income tax:

Alaska

State sales tax rate: 0%

Property tax rate: 0.40%

Average home insurance per year: $1,116

Average car insurance per year: N/A at Insurify due to insufficient data

Other factors: Cities can charge local sales tax up to 7.5%; Alaska also collects significant revenues from the oil industry.

Florida

State sales tax rate: 6%

Property tax rate: 0.91%

Average home insurance per year: $10,996

Average car insurance per year: $2,917

Other factors: Home values have soared, up 70% in five years.

Nevada

State sales tax rate: 6.85%

Property tax rate: 0.59%

Average home insurance per year: $1,224

Average car insurance per year: $2,975

Other factors: Nevada collects significant revenues related to gambling.

New Hampshire

State sales tax rate: 0%

Property tax rate: 1.93%

Average home insurance per year: $1,225

Average car insurance per year: $1,010

Other factors: Charges tax on dividends and interest (but not ordinary income or capital gains), utility bills are very high too.

South Dakota

State sales tax rate: 4.5%

Property tax rate: 1.17%

Average home insurance per year: $2,562

Average car insurance per year: $1,751

Other factors: Charges sales tax on items that are often exempt, such as groceries.

Tennessee

State sales tax rate: 7.0%

Property tax rate: 0.67%

Average home insurance per year: $2,470

Average car insurance per year: $1,572

Other factors: Charges sales tax on items that are often exempt, such as groceries.

Texas

State sales tax rate: 6.25%

Property tax rate: 1.68%

Average home insurance per year: $4,456

Average car insurance per year: $2,359

Other factors: Texas collects significant revenues related to the oil industry.

Washington

State sales tax rate: 6.5%

Property tax rate: 0.87%

Average home insurance per year: $1,437

Average car insurance per year: $1,853

Other factors: Charges 7% tax on capital gains over $250,000.

Wyoming

State sales tax rate: 4.0%

Property tax rate: 0.56%

Average home insurance per year: $2,159

Average car insurance per year: $1,528

Other factors: Charges sales tax on diapers and feminine hygiene products, residential energy costs are very high too.

Article originally published Jul 03, 2024 by Brad Tuttle on Money.com